The following API call allows voiding a bill-payment in QuickBooks Online:

curl -X PATCH \ https://api.openconnectors.us2.ext.hana.ondemand.com/elements/api-v2/bill-payments/IdOfTheBillPayment/void \ -H 'Authorization: User *****, Organization *****, Connector *****' \ -H 'accept: application/json' \

After the bill-payment is voided, a privateNote with the Voided message appears in the response body of the bill-payment. Here is an example of the above API response:

{

"checkPayment": {

"printStatus": "NOT_SET",

"bankAccountRef": {

"name": "10100 Checking",

"value": "58"

}

},

"systemId": "8730",

"syncToken": "1",

"vendorRef": {

"name": "Patton Hardware Supplies",

"value": "11"

},

"metaData": {

"createTime": "2019-06-17T05:54:39Z",

"lastUpdatedTime": "2019-06-17T06:19:30Z"

},

"payType": "CHECK",

"totalAmt": 0,

"privateNote": "Voided - RC 93",

"sparse": false,

"currencyRef": {

"name": "United States Dollar",

"value": "USD"

},

"exchangeRate": 1,

"domain": "QBO",

"id": "8730|1",

"txnDate": "2019-06-16T00:00:00Z"

}

Presently, fetching custom reports is not supported by the vendor API.

No, QuickBooks allows users to search for customers by ‘customerRef.value’. This means that you would have to first make a GET/customers and search by the name. Then you can make your API call for what you are searching for.

Yes. Currently QuickBooks Online supports development of apps in Australia, Canada, India, United Kingdom, and United States.

No, querying by pOStatus is not a supported feature of the QuickBooks Online API. You can perform a full selection from PurchaseOrder and then loop through the result set to pull out the open order details needed. A custom transformation or formula filter is recommended because the QBO PurchaseOrder API does not support using the postatus='OPEN' within the where clause.

Custom fields cannot be added via API calls. Quickbooks does not support the custom fields creation via API calls. This feature is only supported via the Quickbooks UI.

The status for a given payment cannot be changed. The status for a payment object is always set to PAID.

There are currently no known blockers to getting approved on the QuickBooks App Store when utilizing SAP. A few of our users have been successful in getting their app approved for the QuickBooks App Store. More information on the approval process can be found on the QuickBooks Developer Documentation.

The DELETE API call does not erase data, it performs only a SOFT DELETION in Quickbooks Online. Rather than remove the vendor, Quickbooks sets the field “inactive” to “true” when a delete API call is made. The soft deleted records can be later queried using this field.

Quickbooks Online has the following OCNQL limitations:

- OR operator is not supported in where clauses;

- GROUP BY and JOIN operator are not supported;

- Wildcard character support with LIKE clauses is limited to “%” (wildcard that substitutes for 0 or more characters);

- The response set returns all properties for each object (that is, projections are not supported).

Querying invoices according to the purchase order number is unavailable because the purchase order number associated with an invoice is the TxnId field, which is nested inside the entity LinkedTxn. In the Invoice object, the entity LinkedTxn is not queryable.

QuickBooks Online requires a token refresh every 180 days. The refresh cannot occur any sooner than 150 days. We handle the oauth refresh for you in the background by maintaining the last refresh date and determining if a refresh is necessary on each API call.

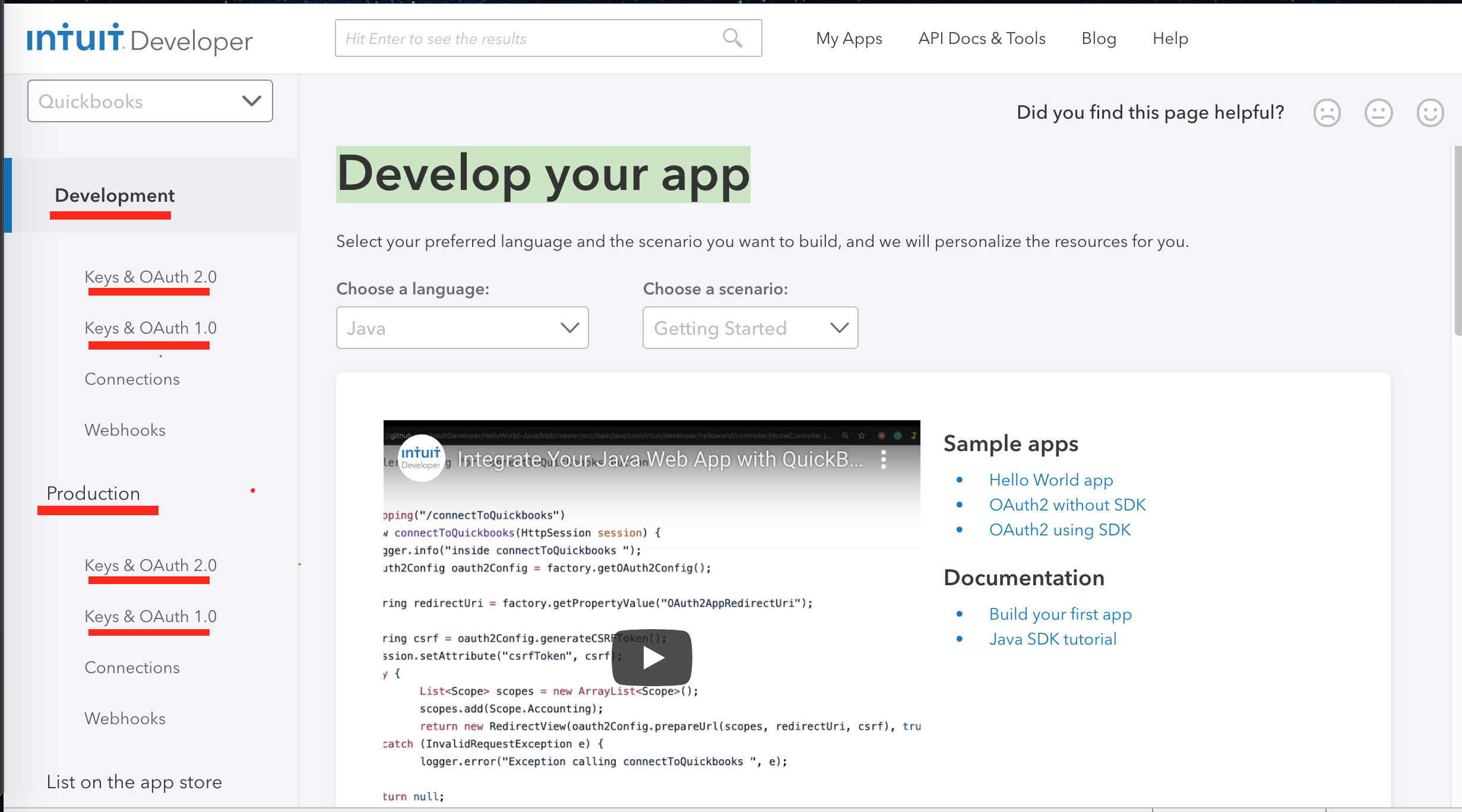

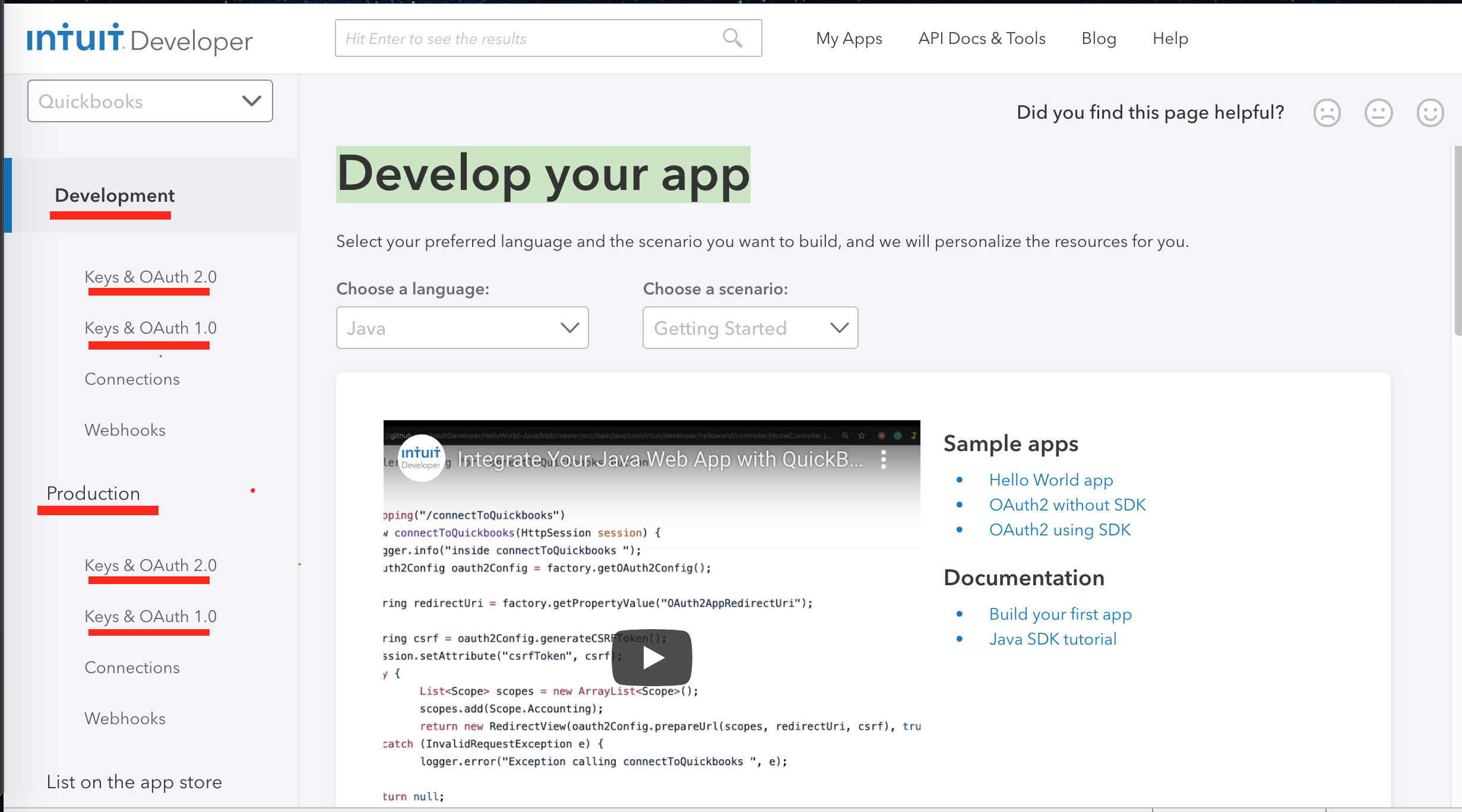

In QuickBooks, there is a difference between developer keys and production keys. If you create an Oauth2 connected app, chances are that app has developer keys. These keys will not allow you to connect to other QuickBooks companies. Reference this documentation for getting production ready keys: Production Keys

QuickBooks Online (QBO) offers free sandboxes to aid in the development of custom QBO applications. Sandbox application credentials can be used to authenticate QBO connector instances and perform all API calls that normal, non-sandbox applications are capable of. Follow these instructions to create your own QBO sandbox application:

- Navigate to the Intuit Developer Portal: https://developer.intuit.com/. Sign up for a developer account if you do not already have one by clicking "Sign Up" in the upper-right corner.

- Navigate to https://developer.intuit.com/v2/ui#/app/startcreate.

- Click the "Select APIs" button under "Just start coding".

- Select the APIs you wish to use. This selection can always be changed later via your app's settings.

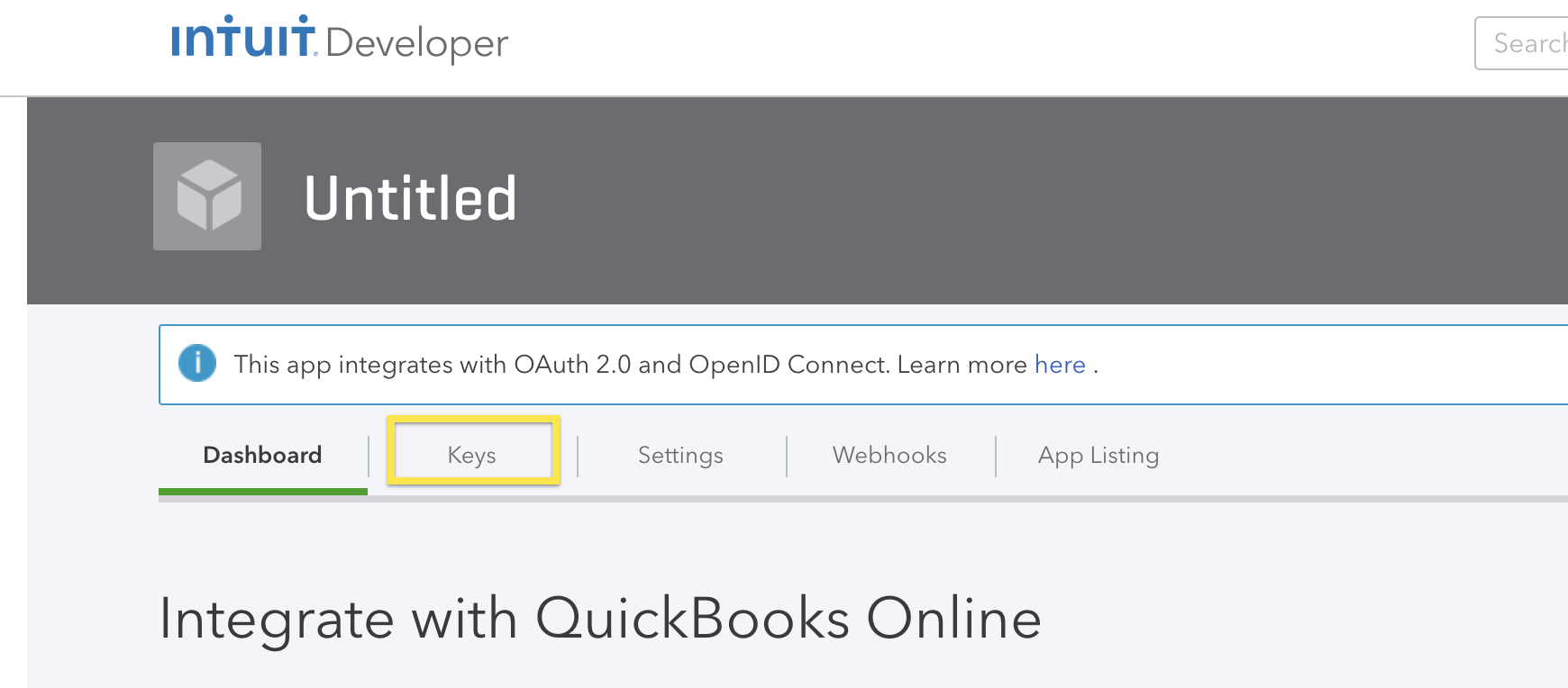

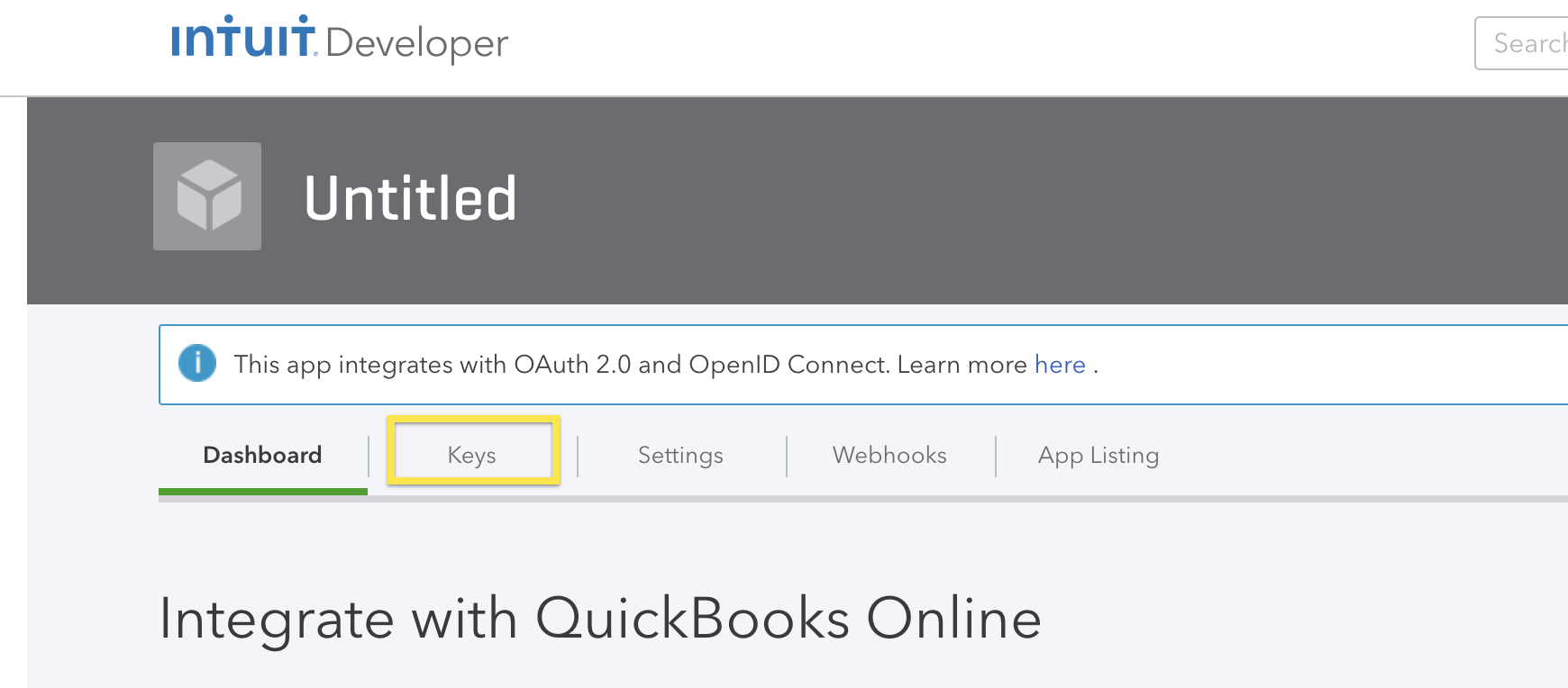

- Click the "Keys" tab to be redirected to a page which contains your API key and secret. This is also where you configure settings for your applications such as which sandbox to connect to (one is automatically created for you when you sign up for a developer account).

- You should now be able to authenticate a QBO a connector instance using the credentials on the "Keys" tab. For more information on authenticating an instance of QuickBooks Online, see this article.

Note: remember to include connect.to.sandbox: true in your POST body to /instances when authenticating an instance using a sandbox application.

Different types of Quickbooks Online reports can be accessed through the GET /reports/{id} endpoint. Each report has their own supported filter fields that can be used to query. For example, if we're looking to retrieve the `AgedPayableDetail` report that has a start date of 2019-01-01, an end date of 2019-03-21, and a report date of 2019-02-21, we'll supply the filter along with the value in our `where` clause.

Curl Request example: curl -X GET \ 'https://api.openconnectors.us2.ext.hana.ondemand.com/elements/api-v2/reports/AgedPayableDetail?where=startDueDate%3D%272014-01-01%27%20AND%20endDueDate%3D%272019-12-21%27%20AND%20reportDate%3D%272019-03-21%27' \ -H 'Authorization: User xxxxxxx, Organization xxxxxxxx, Connector xxxxxxx' \ -H 'accept: application/json' \

Reports and Supported Filters

| Name of Report | Supported Filter Fields |

| AccountList | startCreatedDate, endCreatedDate, createdDateRange, startUpdatedDate, endUpdatedDate, updatedDateRange, columns, accountStatus, orderBy, sortOrder, accountType |

| AgedPayables | reportDate, dateRange, agingPeriod, numberOfPeriods, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| AgedPayableDetail | startDueDate, endDueDate, reportDate, columns, term, pastDue, agingMethod, agingPeriod, numberOfPeriods, vendor |

| AgedReceivables | reportDate, dateRange, agingPeriod, numberOfPeriods, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| AgedReceivableDetail | startDueDate, endDueDate, reportDate, columns, term, pastDue, agingMethod, agingPeriod, numberOfPeriods, customer |

| BalanceSheet | startDate, endDate, dateRange, accountingMethod, groupBy, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| CashFlow | startDate, endDate, dateRange, groupBy, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| ClassSales | startDate, endDate, dateRange, accountingMethod, groupBy, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| CustomerBalance | reportDate, dateRange, groupBy, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| CustomerBalanceDetail | startDueDate, endDueDate, agingMethod, reportDate, columns, orderBy, sortOrder, customerIds, vendorIds, itemIds, classIds, departmentIds |

| CustomerIncome | startDate, endDate, dateRange, accountingMethod, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| CustomerSales | startDate, endDate, dateRange, columns, accountingMethod, groupBy, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| DepartmentSales | startDate, endDate, dateRange, accountingMethod, groupBy, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| GeneralLedger | startDate, endDate, dateRange, columns, accountingMethod, accountStatus, orderBy, sortOrder, accountType, sourceAccountType, accountIds, sourceAccountIds, customerIds, vendorIds, itemIds, classIds, departmentIds |

| ItemSales | startDate, endDate, dateRange, columns, accountingMethod, groupBy, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| InventoryValuationSummary | reportDate, dateRange, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| ProfitAndLoss | startDate, endDate, dateRange, accountingMethod, groupBy, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| ProfitAndLossDetail | startDate, endDate, dateRange, columns, accountingMethod, groupBy, orderBy, sortOrder, paymentMethod, accountType, customerIds, vendorIds, itemIds, classIds, departmentIds |

| TransactionList | vendorIds, transactionType, startDate, startCreatedDate, startUpdatedDate, startDueDate, endDate, endCreatedDate, endUpdatedDate, endDueDate, dateRange, createdDateRange, updatedDateRange, dueDateRange, sourceAccountType, sortOrder, orderBy, qzurl, printed, paymentMethod, name, groupBy, memo, docnum, departmentIds, customerIds, accountingMethod, apPaid, arPaid, classIds, cleared, bothamount |

| TrialBalance | startDate, endDate, dateRange, accountingMethod, summarizeBy |

| VendorBalance | reportDate, dateRange, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

| VendorBalanceDetail | startDueDate, endDueDate, reportDate, columns, dateRange, dueDateRange, orderBy, sortOrder, term, apPaid, agingMethod, vendor, department |

| VendorExpenses | startDate, endDate, dateRange, accountingMethod, customerIds, vendorIds, itemIds, classIds, departmentIds, summarizeBy |

Filter definitions

- dateRange indicating the date range to use to filter the report. See your specific resource for valid values for this parameter: https://developer.intuit.com/docs/api/accounting Report resources > query parameters > date_macro

- createdDateRangeindicating the date range to use to filter the report by create date.

- updatedDateRange indicating the date range to use to filter the report by updated date.

The supported values for date ranges are - Today, Yesterday This Week, This Week-to-date, Last Week, Last Week-to-date, Next Week, Next 4 Weeks, This Month, This Month-to-date, Last Month, Last Month-to-date, Next Month, This Fiscal Quarter, This Fiscal Quarter-to-date, Last Fiscal Quarter, Last Fiscal Quarter-to-date, Next Fiscal Quarter, This Fiscal Year, This Fiscal Year-to-date, Last Fiscal Year, Last Fiscal, Year-to-date, Next Fiscal Year. The default is This Fiscal Year-to-date.

- startDate indicating the start date of a period for the report. The date format is 'YYYY-MM-DD’, e.g., ‘2015-10-03’

- endDate indicating the end date of a period for the report. The date format is 'YYYY-MM-DD’, e.g., ‘2015-10-03’

- startDueDate indicating the start date of a period for the report. The date format is 'YYYY-MM-DD’, e.g., ‘2015-10-03’

- endDueDate indicating the end date of a period for the report. The date format is 'YYYY-MM-DD’, e.g., ‘2015-10-03’

- startCreatedDate indicating the start created date of a period for the report. The date format is 'YYYY-MM-DD’, e.g., ‘2015-10-03’

- endCreatedDate indicating the end created date of a period for the report. The date format is 'YYYY-MM-DD’, e.g., ‘2015-10-03’

- startUpdatedDate indicating the start created date of a period for the report. The date format is 'YYYY-MM-DD’, e.g., ‘2015-10-03’

- endUpdatedDate indicating the end created date of a period for the report. The date format is 'YYYY-MM-DD’, e.g., ‘2015-10-03’

- reportDate provided with the date format of YYYY-MM-DD. The default value is today’s date.

- accountingMethod with supported values of Cash or Accrual. The default is that defined in the company preferences in Quickbooks.

- accountType indicating the account type to use for the filter.

- sourceAccountType indicating the source account type to use for the filter.

The supported values for account types, including the source account type, are - Bank, AccountsReceivable, OtherCurrentAsset, FixedAsset, OtherAsset, AccountsPayable, CreditCard, OtherCurrentLiability, LongTermLiability, Equity, Income, CostOfGoodsSold, Expense, OtherIncome, OtherExpense, NonPosting. The default is to include all account types in the report.

- agingMethod with supported values of Report_date or Current. The default is Current.

- agingPeriod indicating the number of days in the aging period. The default is 30.

- numberOfPeriods indicating the number of periods to be shown in the report. The default is 4.

- arPaid with supported values of All, Paid, Unpaid. The default is Unpaid.

- apPaid with supported values of All, Paid, Unpaid. The default is Unpaid.

- pastDue indicating to number of past due days to use for the filter.

- shipVia indicating the name of the shipping method as specified in the invoice.

- paymentMethod indicating the name of the payment method used, with supported values of Cash, Check, Dinners Club, American Express, Discover, MasterCard, Visa.

- columns a list of comma separated column names in an 'in ()' clause, indicating the column types to be shown in the report.

- orderBy which specifies the column for the sort order for the results. The default is tx_date.

- sortOrder which specifies the sort order for the results. The supported values are ‘ascend’ and 'descend’. The default is ascend.

- groupBy which specifies a criteria to group the the results. The supported values are Total, Month, Week, Days, Quarter, Year, Customers, Vendors, Classes, Departments, Employees, ProductsAndServices. The default value is Total.

- accountIds A comma separated list of account IDs to filter by.

- sourceAccountIds A comma separated list of the source account IDs to filter by.

- customerIds A comma separated list of customer IDs to filter by.

- vendorIds A comma separated list of vendor IDs to filter by.

- itemIds A comma separated list of item IDs to filter by.

- classIds A comma separated list of class IDs to filter by.

- termIds A comma separated list of term IDs to filter by.

- departmentIds A comma separated list of department IDs to filter by.

Uploading attachments to specific objects in Quickbooks Online (QBO) including Invoices and Bills is a straight-forward process, but if you are using the connector API Docs to upload these attachments there is one important note to make. The /attachments endpoints for these objects are available towards the bottom of the API docs within this resource:

/{objectName}/{id}/attachments

The reason for this is to keep the API docs more in line with how QBO actually handles the upload of attachments to objects as a separate API and not as a function of the Transaction Resource APIs themselves. For example you can make POST calls with the uploaded files to these endpoints:

/invoices/{id}/attachments

/bills/{id}/attachments

A Vendor's “BillableStatus” can have the following values: Billable, NotBillable and HasBeenBill.

If you are seeing the below error response when attempting to perform a QuickBooks Online call:

{ "requestId": "xxxxxxxxxxx",

"message": "Authentication with the provider failed. OAuth token refresh may have encountered problems. If problem continues, edit your connector instance and ensure that access has not been revoked from the provider.",

"providerMessage": "3200 - message=ApplicationAuthenticationFailed; errorCode=003200; statusCode=401 – null” }

You can test a shorter refresh interval by using Intuit's Developer Playground using the below steps:

- Go to https://appcenter.intuit.com/Playground/OAuth/IA. Populate the key and secret and then specify how much time (in seconds) you would like to test for the expiration of your tokens.

- Click "Connect to Quickbooks". Go through the Oauth flow.

- After you have completed the Oauth flow, there will be a page that includes a realm id, token and secret. You will use these to POST https://api.openconnectors.us2.ext.hana.ondemand.com/elements/api-v2/instances. You will use the following payload:

{ "element": { "key": "quickbooks" }, "configuration": { "oauth.callback.url":"http://www.cloud-elements.com", "oauth.user.refresh_interval": "<time set in playground>", "quickbooks.realm.id" : "<realm id>", "oauth.user.token":"<token>", "oauth.user.token.secret":"<secret>", "oauth.api.key": "xxxxxxxxxxxxxxxxxxx", "oauth.api.secret": "xxxxxxxxxxxxxxxx", "quickbooks.datasource": "QBO", "oauth.user.refresh_time": "<current time converted to epoch, use http://www.epochconverter.com/>" }, "tags": [ "QBO Token" ], "name": "QBO Token", "externalAuthentication": "initial" } - After you have posted the instance, continually call one of the endpoints from the instance until the refresh interval has expired. For example, if you set it to 120 seconds, make sure you are making API calls for at least two minutes.

- Immediately after the refresh interval has passed, do another call to ensure it is still working.

- Do a GET /instances/{id}. Review the oauth.user.refresh_time and see it has been updated to when the token was refreshed.

NOTE: due to the shorter time interval, you run the risk of getting a "Refresh out of bounds" error message if you don't attempt it within a specified time frame. This is a QuickBooks limitation.

The below error might be seen when trying to sync customer invoices:

java.lang.RuntimeException: {"message":"getCustomerById failure","endpoint":"https://console.cloud-elements.com/elements/api-v2/hubs/finance/customers/1042","headers":{"Content-Type":["application/json"],"Authorization":["Elementxxxxxxxxxxxxxxxxx=, User=xxxxxxxxxxxxxxx"]},"responseStatusCode":"INTERNAL_SERVER_ERROR","responseBody":"{\"requestId\":\"xxxxxxxxxxxxxx\",\"message\":\"Unknown internal error\"}"}QuickBooks Online only allows one connection per user ID. If you create one instance, and a second instance with the same user ID, then the second instance will revoke access to the first one.

QuickBooks online has a sync token attached to each ID. When you perform a GET /invoices call, the ID will appear as: 1234|3. This translates to <id>|<sync token>

The sync token helps manage concurrent requests. Only the request with the most recent sync token will succeed. When you PATCH /invoices, send the ID with the most recent sync token.

QuickBooks Online - Why do I see "This app is not set up to allow connection from your country" when creating an instance

This error is seen when you attempt to create an instance from a country that is not enabled on the QuickBooks Online app. QuickBooks Online allows you to choose several countries for each app. Add the country where you are attempting to connect from as explained in QuickBooks Online Documentation.

At the end of 2019, Quickbooks Online is deprecating their OAuth1 service in favor of using OAuth2. After December 17th, 2019, Quickbooks will be revoking all OAuth1 tokens and no new tokens will be granted. To avoid connection failures, you will need to migrate your OAuth1 QBO connector instances to OAuth2.

SAP Open Connectors is happy to provide the following migration scripts that will handle this for you at this Github Link. Essentially, there are two scripts:

- the first to find all the OAuth1 QBO instances that need to be migrated

- the second to migrate those instances to OAuth2

You will need to supply the following pieces of information to the first script:

- User Secret

- Organization Secret

- Your SAP Open Connectors Environment (Staging or Prod)

You will need to supply the previous information into the second script, as well as:

- OAuth 2.0 Client Id associated with your OAuth 1.0 application

- OAuth 2.0 Client Secret associated with your OAuth 1.0 application

- List of instances procured by running the first script

Special Notes:

- The migration endpoint is /migrate-tokens

- In your header, you still need your full Auth Header which includes User+Organization+Element.

- In the payload, you want to include the following:

- {

"client_id": "XXXXX",

"client_secret": "XXXXX"

}

- {

- Ensure you are using the proper key type, Development vs Production. You want to use the matching key types based on your QBO app. So if the OAuth1 app instance is using Production keys you will want to use OAuth2 Production keys for the migration.

- Note the areas underlined in Red to find Keys

- Note the areas underlined in Red to find Keys

- The oauth.callback_url on the existing OAuth1 instance must match the Redirect URIs setup in the OAuth2 app.

- Quickbooks only accepts redirect urls that use HTTPS and does not support HTTP, therefore you will need to make sure the redirect url's in your QBO app are using HTTPS for any instance you want to migrate.

- Only valid OAuth1 tokens can be migrated to OAuth2 so if you have an invalidated instance returning 401s it must be re-authenticated prior to OAuth2 migration.